Whilst no accountant really wants to see a “shoe box full of receipts” it is important that you keep records to substantiate your deductions, and that the correct information is given to your accountant to prepare your tax return.

We regularly see media warnings about the ATO cracking down on work related expense claims. It is also a requirement that you keep your tax records for 5 years, and we all know that modern receipts don’t last that long!

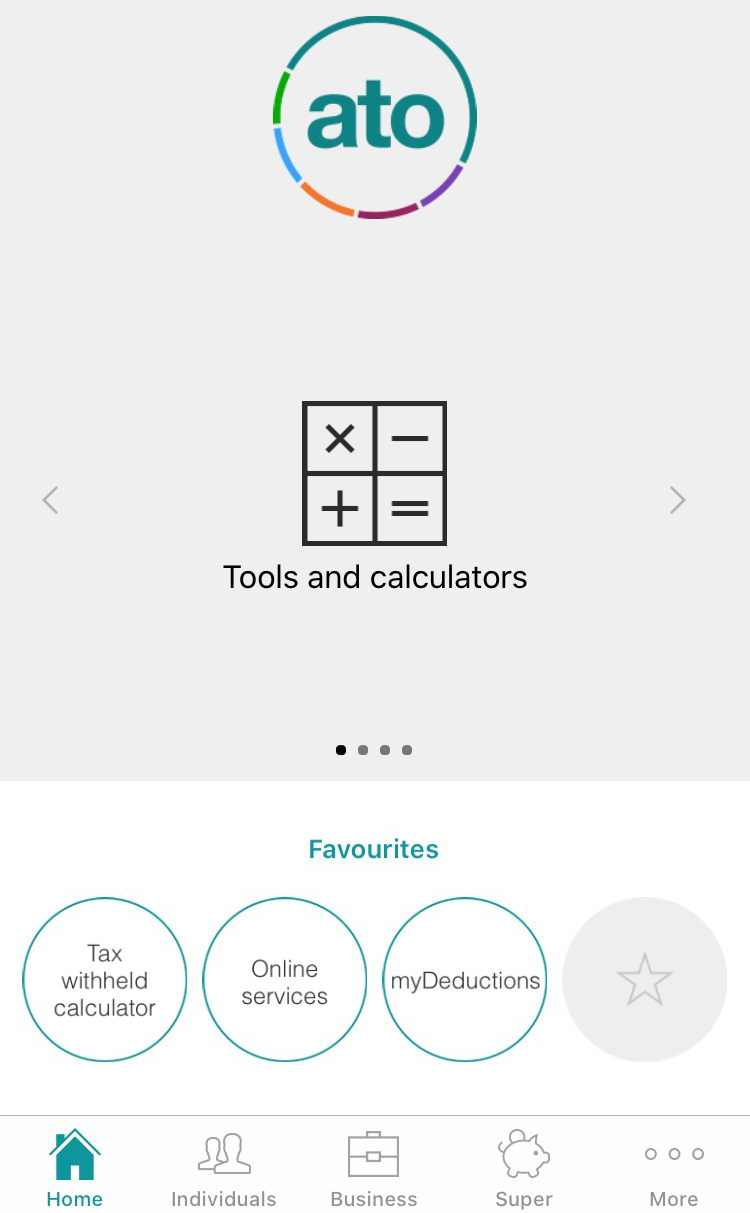

One of the easiest ways to keep track of all your receipts is the ATO’s own app, available via Apple and Googles App Stores. Photos can be stored of your receipts and totals across the categories compiled. At the end of the year you can email the data to me at GQ Tax straight from the app. If you use a vehicle for work purposes, you can even track your travel, handy whether you use the log book method or c/km.

For a quick video overview, check out this video from the ATO.

Thank you Grant, for providing really useful up to date information. I’m looking forward to using the ATO’s App to track my receipts.

LikeLiked by 1 person