Details of the Federal Governments stimulus package to help get the Australian economy through the Covid-19 Coronavirus pandemic: The instant asset write off has been increased to $150,000. For capital items purchased from today 12th March 2020 until 30 June 2020 you will be able to claim an immediate deduction, no need to depreciate theContinue reading “Covid-19 Government Stimulus Package”

Author Archives: gqtax

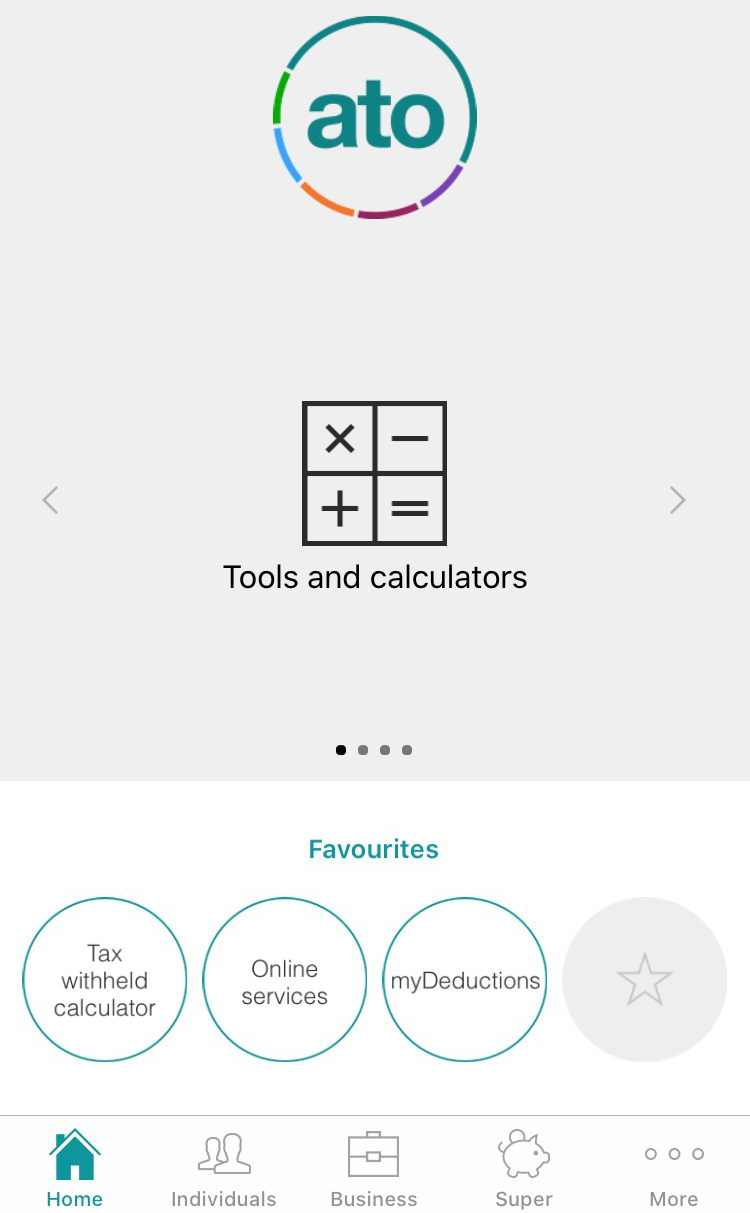

Keeping records: ATO App

Whilst no accountant really wants to see a “shoe box full of receipts” it is important that you keep records to substantiate your deductions, and that the correct information is given to your accountant to prepare your tax return. We regularly see media warnings about the ATO cracking down on work related expense claims. ItContinue reading “Keeping records: ATO App”

Senate inquiry OK’s $10,000 cash limit bill

You may soon be banned from paying cash for amounts greater than $10,000. The Senate’s Economics Legislation Committee has recommended that the bill be passed. Details here: https://www.accountantsdaily.com.au/business/14087-government-given-the-green-light-over-10k-cash-limit-bill