Working from home or using your car to deliver products to homes? You may be entitled to tax deductions that you haven’t been previously. Now is the time to start keeping your records!

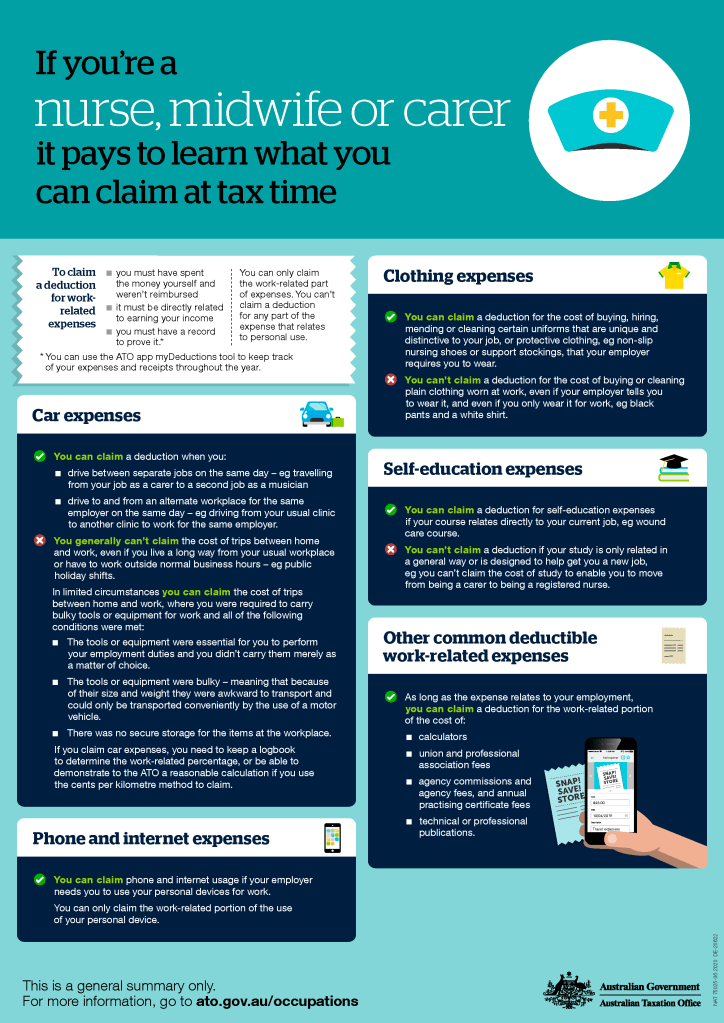

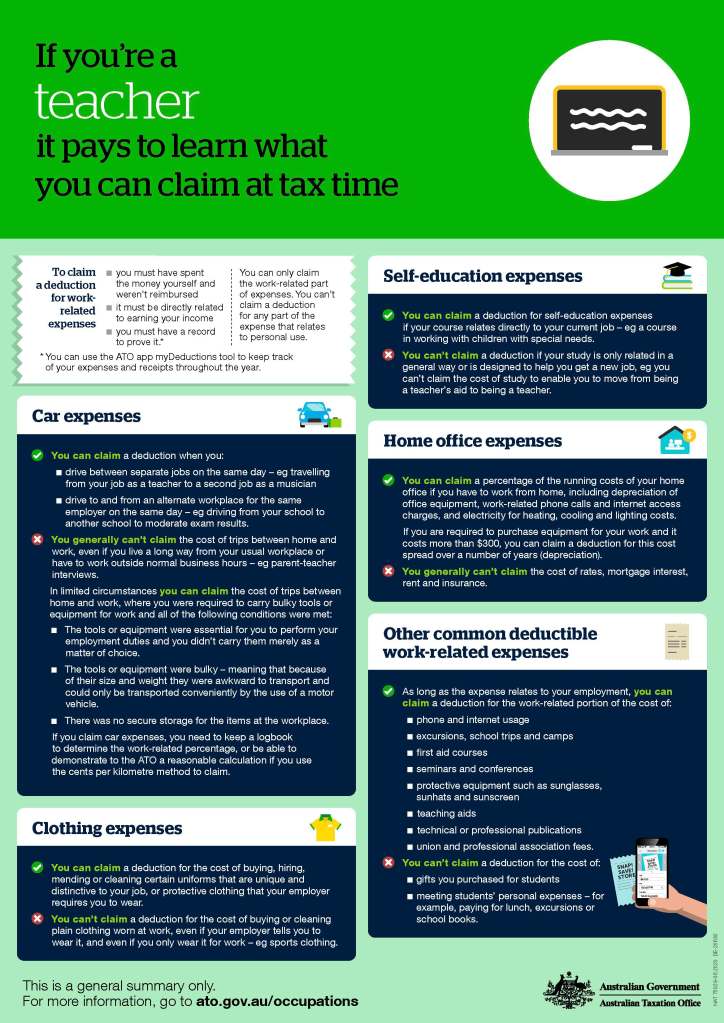

Home Office Expenses

If you’re working from homey may be able to claim for running expenses (detailed below) and/or use of your phone and internet. Generally you will NOT be able to claim for occupancy expenses such as council rates, land taxes, home insurance, mortgage interest or rent.

Running Expenses

Running expenses are things like electricity usage, cleaning, decline in value of equipment and furniture, repairs to equipment and furniture and stationery. Keep your receipts for items you buy (I recommend using the ATO app to photograph them). Items under $300 can be claimed fully in the year of purchase.

There is a simple way and a difficult way to claim your electricity, cleaning and and furniture items over $300. The simple way is to keep a record (e.g. in your diary, notebook or a spreadsheet) of the number of hours per day you spend working in your home office. At the end of the year you add those hours and then claim 52 cents per hour. Keep your record of hours as evidence for your claim. The difficult method involves calculating the actual expenses for these items and involves calculating the proportion of your bills based on the floor area of your workspace. This method gets particularly complicated if you don’t have a dedicated room as your office or you are sharing this space with other family members.

Computer and other equipment that is not furniture over $300 will need to be depreciated (you claim some of the cost over a number of years) whichever of the above methods you use.

Phone & Internet

If your claim for phone usage is small (up to $50) you can claim on a per call basis, keeping a record in your diary of your usage:

- 25 cents per call from a landline

- 75 cents per call from a mobile

- 10 cents per tex message.

To claim more than $50 on your phone usage or to claim any internet expense you will need an itemised bill or a complete record of your usage that covers a period of four weeks. Many people of course no longer receive itemised bills, but you should be able to access your account via your provider’s website. You can calculate your claim in the following ways:

- Calculate the number of work calls as a percentage of total calls

- Calculate the time spent on work calls as a percentage of total calls

- Calculate the amount of data downloaded as a percentage of total downloads (in the age of video streaming services this percentage may be quite low).

Once you have calculated these percentages over a 4 week period, you can apply that same percentage for the period you are working from home.

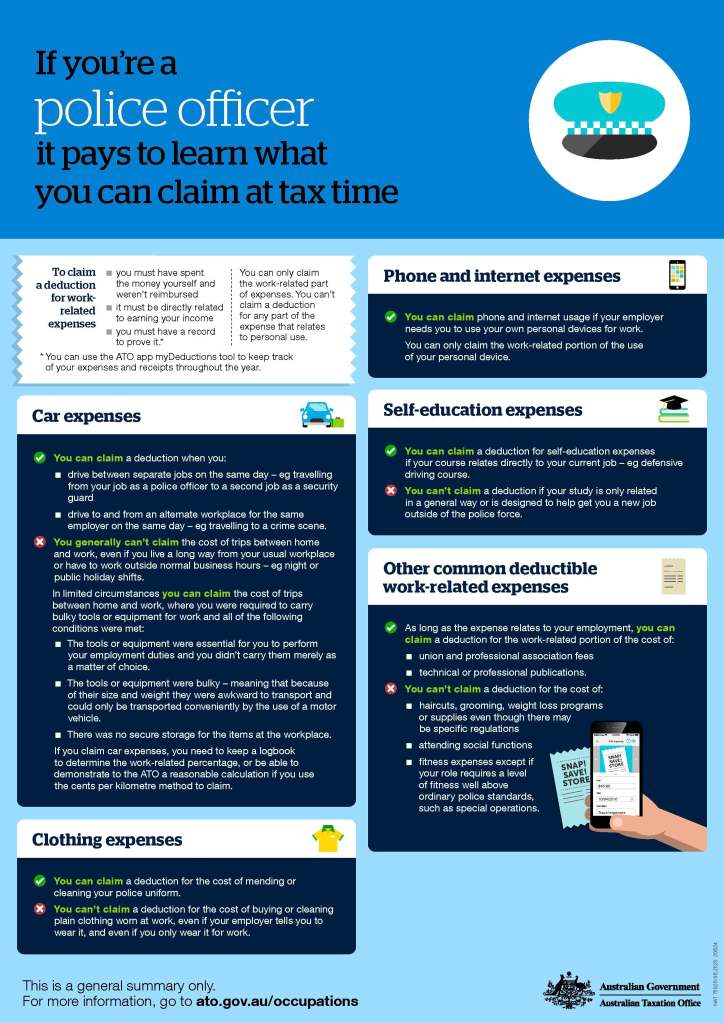

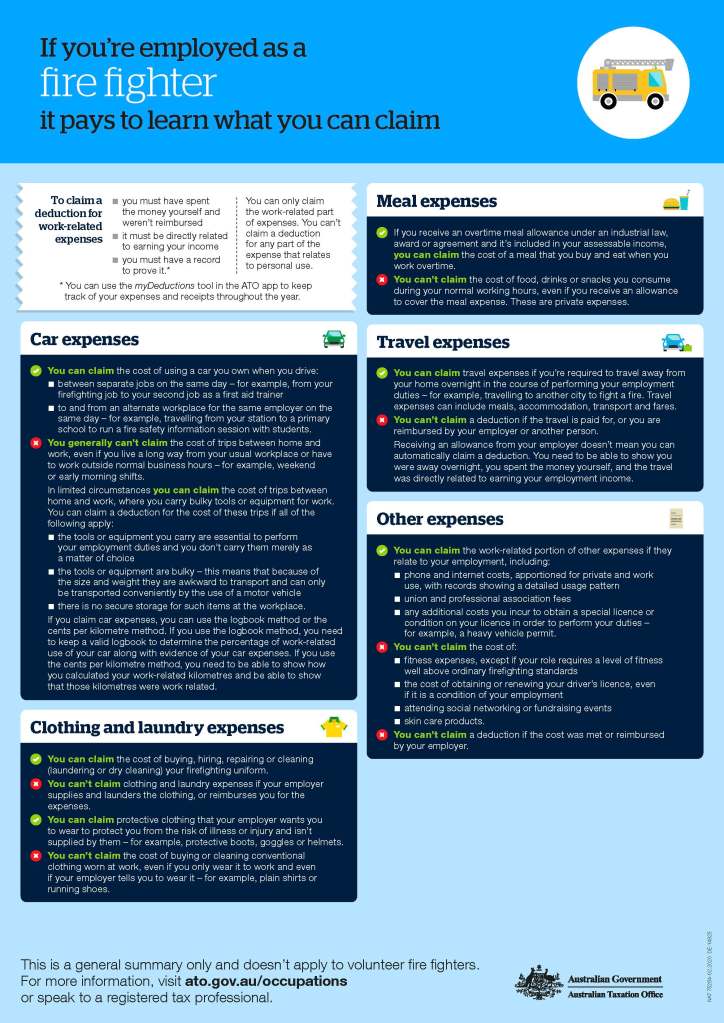

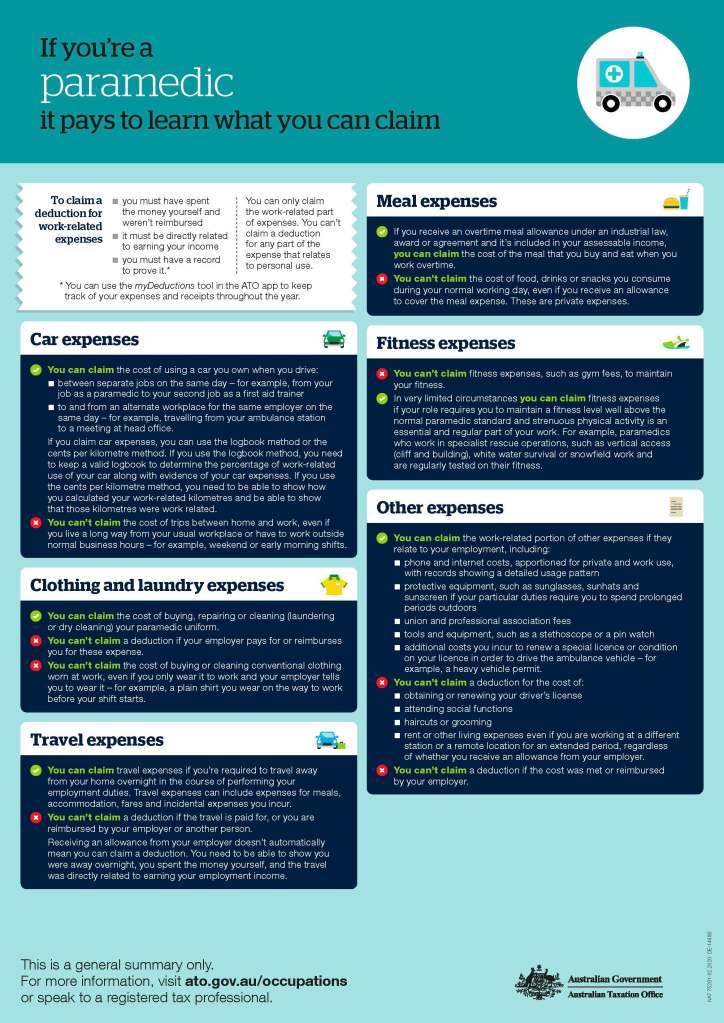

Car Expenses

If you use your own car for work purposes, you can claim a deduction using the cents per kilometre method or logbook method. If you use someone else’s car for work purposes, you can only claim for direct costs you pay for – such as fuel.

Cents per kilometre

You can claim up to a maximum of 5,000 km per vehicle at a rate of 68 c/km. You need to keep a record of your km travelled, either via a diary or I recommend the ATO app. You can’t use the c/km method if your vehicle is a motorcycle or has a carrying capacity more than 1 tonne or nine people.

Logbook

This method is more complicated that the c/km method but is useful if you travel more than 5,000 km. Again I recommend using the ATO’s own app to help your logbook recording. For a period of 12 continuous weeks you need to record all work related travel as a percentage of all travel. This percentage is then used to apportion all vehicle costs over the period you are using your vehicle for work. You will need to keep records and apportion all running costs of your vehicle such as:

- Fuel and oil

- Services & tyres

- Rego

- Insurance

- Interest on car loan (but not the principal)

You can’t claim for the purchase price of a car, including additions such as window tinting or paint protection.

You need to record your odometer reading at the start and end of each year you claim for car expenses. If your pattern of use changes, you must recalculate your percentage.

ATO fact sheets can be found here:

Home office expenses

Car expenses