The ATO summaries for police, fire fighters and paramedics are fairly similar, but this year the ATO have produced separate guides for each of you.

Category Archives: Tax

Nurses Tax Time Guide

Nurses, check out this handy ATO summary of what you can claim at tax time. Call 0481 02 44 66 to book your appointment.

Teacher Tax Time

Teachers, do you know what you can claim at tax time? Check out this handy ATO guide then call me on 0481 02 44 66 to book your appointment.

Working from home?

Working from home or using your car to deliver products to homes? You may be entitled to tax deductions that you haven’t been previously. Now is the time to start keeping your records! Home Office Expenses If you’re working from homey may be able to claim for running expenses (detailed below) and/or use of yourContinue reading “Working from home?”

Second Federal Government Support Package

On Sunday 22nd March the Federal Government announced a second round of support to individuals and businesses as a result of the Covid-19 Pandemic. The following is a summary of the measures as they relate to individuals, sole traders and partnerships: Individuals who receive support payments (Jobseeker Allowance, Youth Allowance, Parenting Payment, Farm Household Allowance)Continue reading “Second Federal Government Support Package”

COVID-19 ATO Support

The ATO website now has a dedicated page detailing their assistance available for small businesses affected by the Covid-19 Coronavirus pandemic. https://www.ato.gov.au/…/In-de…/Specific-disasters/COVID-19/

Covid-19 Government Stimulus Package

Details of the Federal Governments stimulus package to help get the Australian economy through the Covid-19 Coronavirus pandemic: The instant asset write off has been increased to $150,000. For capital items purchased from today 12th March 2020 until 30 June 2020 you will be able to claim an immediate deduction, no need to depreciate theContinue reading “Covid-19 Government Stimulus Package”

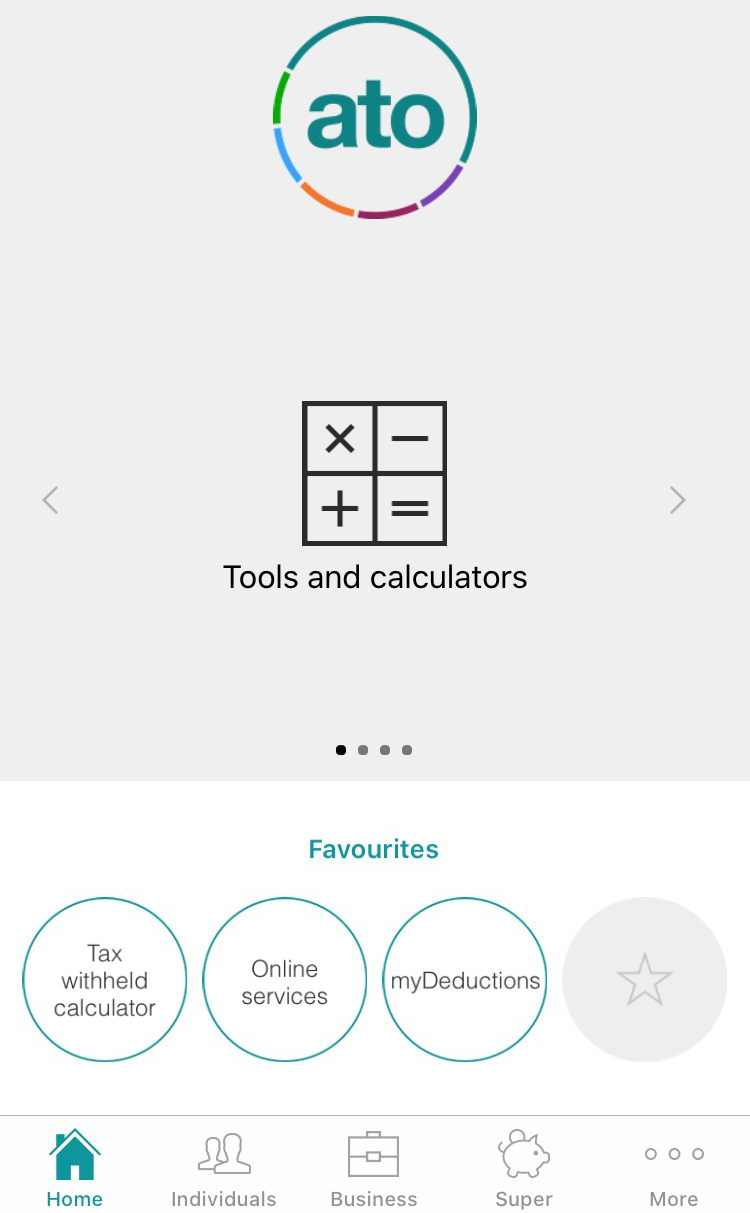

Keeping records: ATO App

Whilst no accountant really wants to see a “shoe box full of receipts” it is important that you keep records to substantiate your deductions, and that the correct information is given to your accountant to prepare your tax return. We regularly see media warnings about the ATO cracking down on work related expense claims. ItContinue reading “Keeping records: ATO App”

Senate inquiry OK’s $10,000 cash limit bill

You may soon be banned from paying cash for amounts greater than $10,000. The Senate’s Economics Legislation Committee has recommended that the bill be passed. Details here: https://www.accountantsdaily.com.au/business/14087-government-given-the-green-light-over-10k-cash-limit-bill